28+ deduct interest on mortgage

If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

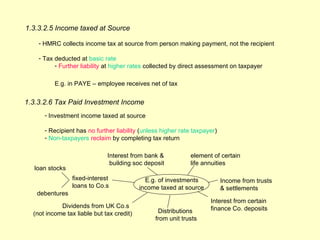

Cemap 1 Final Copy

Web The mortgage interest deduction allows homeowners who itemize their deductions on their tax forms to deduct their interest on qualified personal residence.

. Homeowners who are married but filing. Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. 13 1987 your mortgage interest is fully tax deductible without limits.

Compare Lenders And Find Out Which One Suits You Best. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The home is in my dads name.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. You have to be either on. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Any mortgage taken out before October 13 1987 is considered grandfathered debt and is not limited. Web Taxpayers who took out a mortgage after Dec. 12950 for tax year 2022.

Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. You are not indebted so you cant deduct it. Single taxpayers and married taxpayers who file separate returns.

15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. Looking For Conventional Home Loan. Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web Home mortgage interest. Comparisons Trusted by 55000000. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Web Standard deduction rates are as follows. 1 2018 youre allowed to deduct the interest paid on up to 1 million of home acquisition debt plus 100000 of home. Qualified residence interest is interest indebted to the taxpayer.

Married taxpayers who file. Web Is the mortgage interest 100 tax deductible. 5 Best Home Loan Lenders Compared Reviewed.

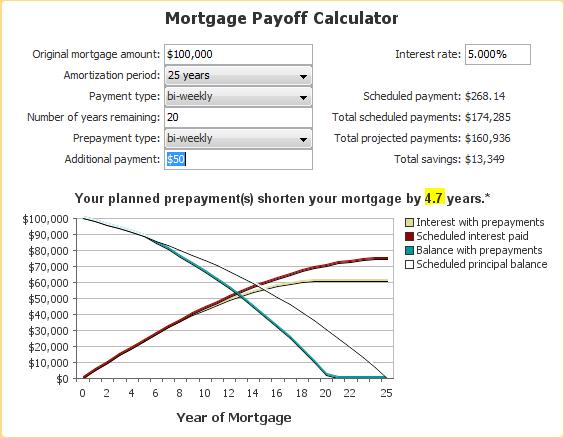

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Mortgage interest deduction limits If you took out your mortgage on or before Oct.

Web Most homeowners can deduct all of their mortgage interest. However higher limitations 1. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web If you took out your mortgage before Jan. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Rates Housing Finance Capital Markets Khan Academy Youtube

Fixed Rate Mortgage Wikipedia

Mortgage Interest Deduction Save When Filing Your Taxes

Unity Credit Union Mortgage Disclosure

Young And High Net Worth What S Next Bogleheads Org

Financial Accounting Ii Pdf Securities Finance Investing

What Is The Mortgage Interest Deduction The Ascent

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

The Home Mortgage Interest Deduction Lendingtree

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Is Mortgage Interest Deductible In 2023 Consumeraffairs

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction A 2022 Guide Credible

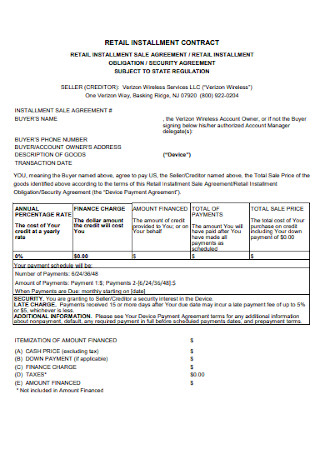

28 Sample Installment Contract Templates In Pdf Ms Word

What Your Mortgage Interest Rate Really Means Money Under 30

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb